This section draws together the due diligence elements identified from the analysis on this sectoral guidance.

|

Category |

Red Flag |

Source |

|

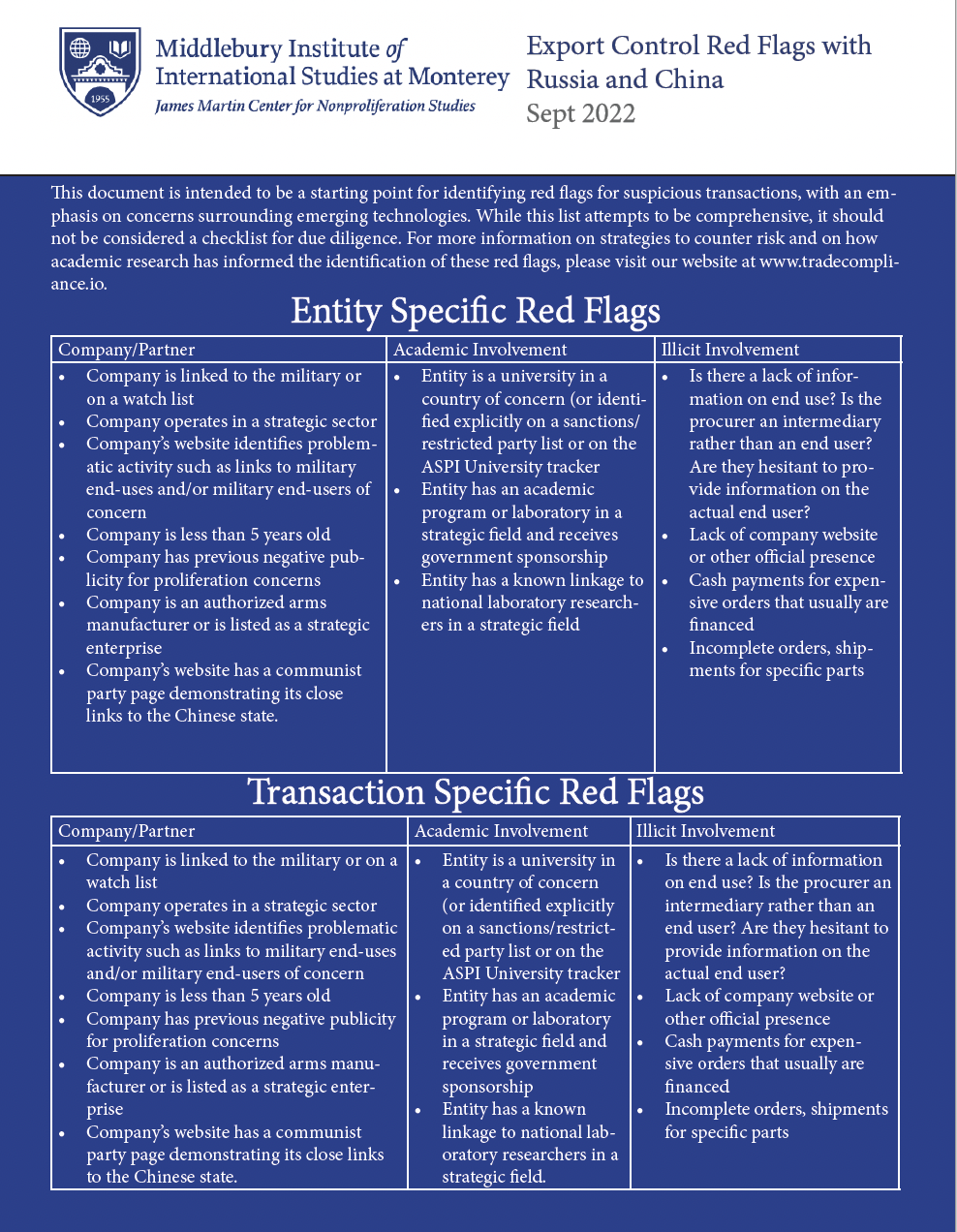

Company/Partner |

|

Company website, LinkedIn, news media coverage, sanctioned entity lists (in particular, the China country section of the U.S> BIS Entity List, and the U.S. DoD’s “Chinese Military Companies List” per Section 1260H of the NDAA of 2021; and the U.S. Treasury Dept. OFAC’s “Non-SDN Chinese Military-Industrial Complex Company List (NS-CMIC List)). |

|

Academic Involvement |

|

University website; U.S. BIS Entity List; Japan Foreign End-User List, (maybe EU / UK) ASPI Tracker |

|

|

Technology control lists, product order |

|

Shipping |

|

Product order |

|

Illicit Involvement |

|

See also the distributors section below |

|

Geography and Third Country Diversion |

|

|

|

China Specific Red Flags |

|

|

|

Transaction |

|

|

| Russia Specific Red Flags |

|