Overview

New export controls on semiconductors to Russia, in combination with sanctions impacting the Russian economy. Some estimates put the trade of semiconductors to Russia at $50 billion.[1] But these impressive number bely the fact that Russia buys end products with chips and integrated circuits and does not have a strong industrial base to produce cutting edge semiconductors themselves despite attempts by the Kremlin to build a domestic production capacity.[2]

Russia’s Global Trade Flows

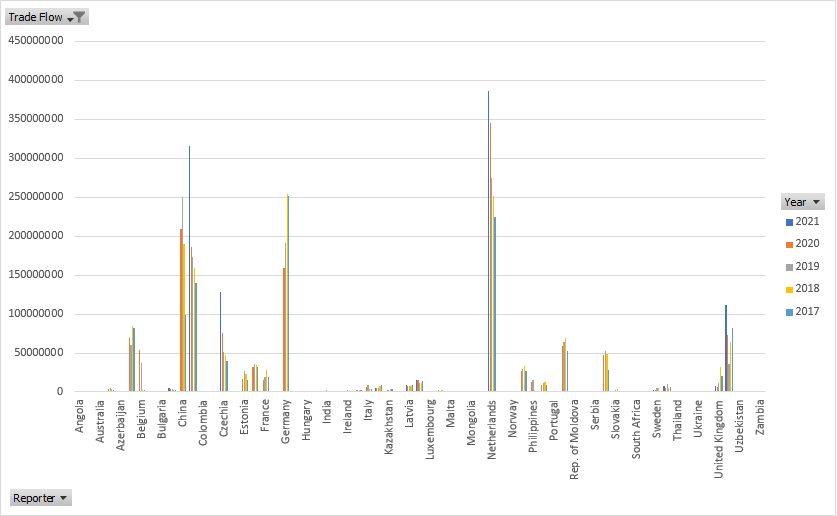

CNS analyzed trade flows of semiconductors and electronics into Russia to measure the current international supply chains Russia is relying on to keep her economy running. Firstly, we analyzed COMTRADE data from the United Nations using the Harmonized System data countries report they are exporting to Russia. We used two four-digit HS (Harmonized System) codes to filter for only goods relevant to the semiconductor and microelectronics industries. This meant using codes 8541 and 8542, for semiconductors and electronic integrated circuits, respectively. The goods were measured in U.S. dollars from the 2017 to 2021 period.

What we found was two distinct trade flows. The larger of the two routes stretches towards the Atlantic, constituting primarily the Netherlands, Germany, and United States to a lesser extent. The Netherlands was the leading reporting of trade, with totals reaching $1.48 billion in goods. Germany and the United States came in second with $856 million and $366 million in goods, respectively from 2017 to 2021. The smaller, but still extremely significant of the two trade flows stretches towards the Pacific, constituting supply chains from China and Hong Kong. The dominance of trade from China and Hong Kong fluctuated based on year, but $973 million in goods were reported by Hong Kong over the four-year period with $746 million coming from the Chinese mainland.

It is important to note the breadth and variety of semiconductors and integrated circuits. The goods Russia imports run the gamut of sophistication levels and are not all the high-end semiconductors that are the focus of the U.S.-China technology arms race, but lower end electronics for all number of industrial applications.

Asian Supply Chains

Logically, given geography and geopolitical leanings, there is concern China itself may step in to provide a workaround for getting semiconductors into Russia. This would mean higher prices for Russian end users and increased risk for any Chinese supplier. Fearing this, U.S. Secretary of Commerce Gina Raimondo came out on March 8th and threated to further cut-off China from American goods and software if Chinese companies served to undermine U.S. export restrictions and sanctions. U.S. officials have specifically threatened to punish the Shanghai-based and partially state-owned Semiconductor Manufacturing International Corporation (SMIC) for any trade with Russia.[3] SMIC is already on the US ‘entity list’ meaning that all US trade with the entity must be referred to the licensing agency.[4]

The impact of Taiwan joining the export controls could be extremely consequential for its success. Given TSMC’s outsized role in the high-end semiconductor industry, market cut-off alongside U.S. decoupling cuts off Russia’s basic electronic manufacturing base is virtually nonexistent much less a capacity to manufacture high-end chip manufacturing equipment akin to Dutch EUV innovators at ASML.[5] This is all despite government subsidies to push forward Russia’s chip manufacturing abilities.[6] This is due to several factors, including lack of development during the Soviet period, lack of qualified staff, lack of basic research, and theft by state officials.[7]

Nvidia, AMD and Intel have also pulled out of the Russian market, defacto locking Russia out of personal computers, laptops, and supercomputers.[8] AMD specifically referred to U.S. “sanctions” as the reason for the company’s pullout, without elaborating if export controls or financial restrictions were more to blame.[9] This is a direct blow to Russia’s participation in the machine learning race, as Sberbank’s Christofari supercomputer was created in collaboration with Nvidia.[10]

Impact on Global Semiconductor Markets

A secondary risk is that as a major commodity exporter, Russia’s invasion of Ukraine could impact the availability of raw materials needed to produce some semiconductors. The most relevant components to the Russia context being neon gas and pallidum.[11] Russia supplies half of the world’s neon gas, much of which is then further processed in Ukraine before entering global supply chains.[12] This supply chain provides 90% of the neon gas used by the U.S. semiconductor industry to produce chips.[13] Dutch semiconductor giant ASML reduced their reliance on neon gas in their processes after the Crimea annexation.[14] One business analyst told Fortune magazine, “Unless Ukraine becomes a long, drawn-out war, lasting over a month, there should be little impact on neon supplies”.[15]

Conclusion

Since Peter the Great traveled the European shipyards 300 years ago, opening the so-called window to Europe, Russia has relied on Western technology transfers for modernization. The world is more globalized now, but Russia continues to rely on technology transfers for development. Russia attempted import substitution of electronics after the 2014 annexation of Crimea, but many of these attempts were marred by corruption and failure.[16] The semiconductor export controls stand to leave Russia weaker, poorer, and more isolated in a way the country has not seen since the Soviet Union.

[1] https://fortune.com/2022/02/25/biden-ban-chip-semiconductors-exports-russia-ukraine/

[2] https://www.kommersant.ru/doc/5029560?query=%D0%B0%D0%BE%20%D0%BC%D0%B8%D0%BA%D1%80%D0%BE%D0%BD and https://www.kommersant.ru/doc/4955528?query=%D0%B0%D0%BE%20%D0%BC%D0%B8%D0%BA%D1%80%D0%BE%D0%BD

[3] https://www.nytimes.com/2022/03/08/technology/chinese-companies-russia-semiconductors.html

[4] https://www.federalregister.gov/documents/2020/12/22/2020-28031/addition-of-entities-to-the-entity-list-revision-of-entry-on-the-entity-list-and-removal-of-entities#:~:text=This%20rule%20adds%20SMIC%20and,)%20Co.%2C%20Ltd.%3B

[5] https://fortune.com/2021/10/19/asml-chips-euv-silicon-valley-biden/

[6] https://www.kommersant.ru/doc/4978092?query=%D0%B0%D0%BE%20%D0%BC%D0%B8%D0%BA%D1%80%D0%BE%D0%BD

[7] https://novayagazeta.ru/articles/2018/02/26/75605-synki-otechestva and

[8] https://www.pcworld.com/article/619357/amd-officially-halts-chip-sales-to-russia.html

[9] ibid

[10] https://www.sberbank.com/news-and-media/press-releases/article?newsID=be3c0f17-e57a-49f7-bf64-900e6e81cb3f&blockID=7®ionID=77&lang=en&type=NEWS

[11] https://www.wsj.com/articles/chip-makers-stockpiled-key-materials-ahead-of-russian-invasion-of-ukraine-11647167582

[12] https://www.smh.com.au/business/markets/semiconductor-squeeze-likely-as-sanctions-on-russia-melt-supply-20220311-p5a3to.html

[13] https://www.smh.com.au/business/markets/semiconductor-squeeze-likely-as-sanctions-on-russia-melt-supply-20220311-p5a3to.html

[14] https://www.aljazeera.com/economy/2022/3/3/amid-ukraine-fallout-crisis-hardened-chipmakers-race-to-adapt

[15] https://fortune.com/2022/02/25/biden-ban-chip-semiconductors-exports-russia-ukraine/

[16] https://novayagazeta.ru/articles/2018/02/26/75605-synki-otechestva